Business Insurance in and around Fort Worth

Calling all small business owners of Fort Worth!

Almost 100 years of helping small businesses

Coverage With State Farm Can Help Your Small Business.

It takes courage to start your own business, and it also takes courage to admit when you might need a hand. State Farm is here to help with your business insurance needs. With options like worker's compensation for your employees, a surety or fidelity bond and errors and omissions liability, you can rest assured that your small business is properly protected.

Calling all small business owners of Fort Worth!

Almost 100 years of helping small businesses

Cover Your Business Assets

Whether you own a barber shop, a cosmetic store or a toy store, State Farm is here to help. Aside from excellent service all around, you can personalize a policy to fit your business's specific needs. It's no wonder other business owners choose State Farm for their business insurance.

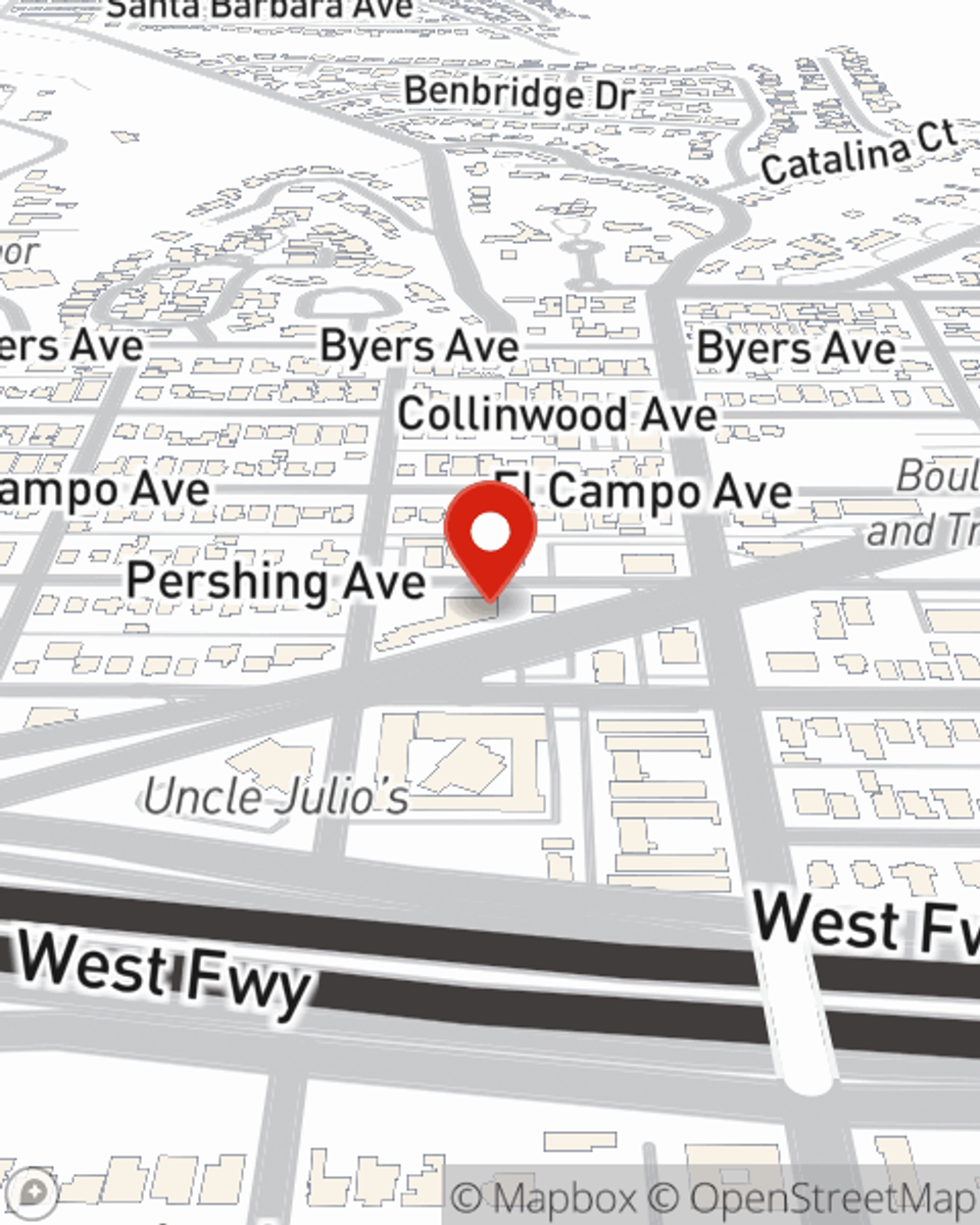

Ready to learn more about the business insurance options that may be right for you? Contact agent Judy Samuel's office to get started!

Simple Insights®

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.

Judy Samuel

State Farm® Insurance AgentSimple Insights®

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.